How Big Is the Global Pet Insurance Market and Why Is It Growing So Fast?

The global Pet Insurance Market has become one of the fastest-growing segments in the broader insurance and pet-care industries. With rising pet ownership, growing awareness about pet health, and the rapid expansion of veterinary services, pet insurance is moving from a luxury product to an essential component of responsible pet ownership. This article provides a business-oriented and data-driven overview of the global pet insurance market—covering market size, share, growth trends, and emerging opportunities shaping the industry’s future.

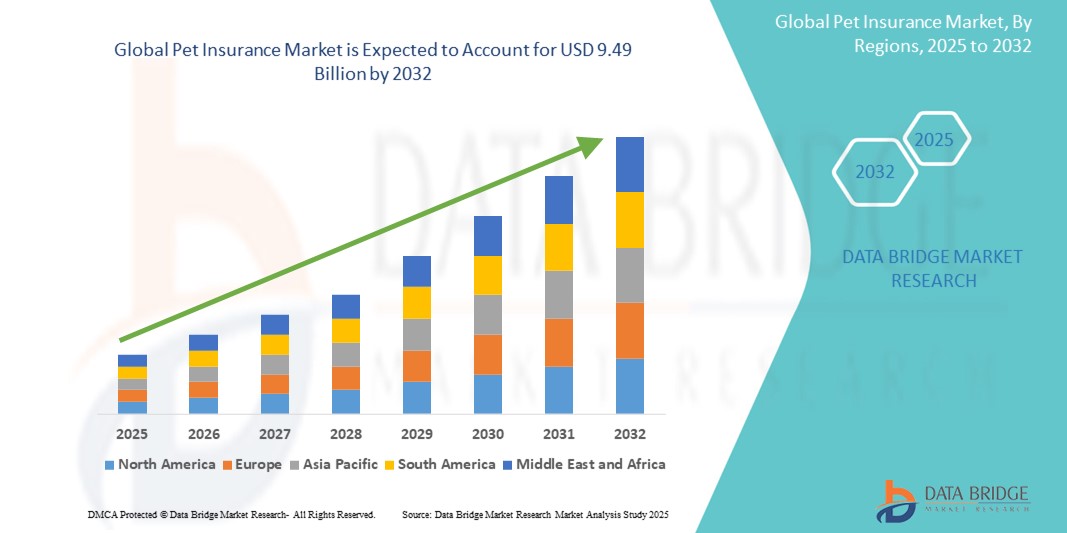

Market Size and Growth Outlook

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period.

- The market growth is largely fueled by the increasing pet adoption rates and heightened awareness among pet owners regarding the rising costs of veterinary care, prompting a greater need for financial protection and comprehensive pet health coverage

- Furthermore, the growing demand for customized, user-friendly, and digitally accessible insurance plans is establishing pet insurance as a vital component of responsible pet ownership. These converging factors are accelerating the uptake of pet insurance solutions, thereby significantly boosting the industry's growth

The growing demand for quality veterinary services and advanced medical treatments has made pet care more expensive. Pet owners are now more aware of financial protection against unforeseen medical costs, leading to a surge in policy purchases. Furthermore, insurers are offering flexible, digital-first insurance plans with broader coverage options—ranging from accident-only to lifetime comprehensive health protection.

The market’s value is expected to rise substantially during the forecast period, indicating strong investor interest and industry confidence. The combination of higher spending on pet healthcare and growing awareness among owners will continue to fuel the expansion of this market globally.

[caption id="" align="alignnone" width="1067"]

pet insurance market[/caption]

pet insurance market[/caption]

Get Full Insights: https://www.databridgemarketresearch.com/reports/global-pet-insurance-market

Market Share and Competitive Landscape

North America currently dominates the pet insurance market, holding a significant share of global revenue. The United States, in particular, leads in policy adoption due to strong awareness, established veterinary infrastructure, and wide availability of insurance plans.

Europe follows closely, with the United Kingdom, Germany, and France among the leading countries offering a variety of pet coverage options. Meanwhile, Asia-Pacific is projected to witness the fastest growth due to rising pet adoption, increasing disposable income, and expanding middle-class populations in countries such as China, Japan, and India.

Key players in the global pet insurance market include specialized insurance providers, large multinational insurers, and emerging digital insurtech companies. These companies are focusing on strategic partnerships with veterinary networks and pet service providers to expand their customer base and improve claim experiences. Competitive strategies are centered on product innovation, customer education, and leveraging data analytics for personalized pricing.

Get Sample PDF : https://www.databridgemarketresearch.com/request-a-sample?dbmr=global-pet-insurance-market

Segmentation Analysis

The global pet insurance market can be segmented based on coverage type, animal type, and distribution channel.

By Coverage Type

-

Lifetime Coverage:

Lifetime plans account for the largest market share. These policies provide comprehensive protection throughout a pet’s life, covering chronic illnesses, surgeries, and ongoing treatments. The growing preference for long-term protection drives this segment’s dominance. -

Accident-Only Coverage:

This segment is gaining traction among first-time buyers due to affordability. Accident-only policies cover injuries from unforeseen events such as accidents or emergencies, appealing to budget-conscious pet owners. -

Non-Lifetime Coverage:

These plans provide coverage for specific periods or illnesses and are often chosen by owners seeking mid-range options between accident-only and lifetime plans.

By Animal Type

-

Dogs:

Dogs hold the largest revenue share within the pet insurance market due to their higher ownership rate and the relatively higher cost of veterinary treatments. -

Cats:

The cat insurance segment is expected to witness rapid growth as urban pet ownership rises and awareness of feline health increases. -

Other Animals:

Coverage for exotic pets, birds, and horses is emerging as a niche opportunity in premium insurance categories.

By Distribution Channel

-

Direct Sales:

Direct-to-consumer online sales dominate, driven by user-friendly digital platforms and mobile applications offering instant quotes and policy management. -

Brokers and Agents:

Insurance brokers are seeing increased demand for personalized guidance, particularly among new pet owners exploring complex coverage options. -

Bancassurance and Other Channels:

Banks and third-party distributors are partnering with insurance firms to offer bundled pet-care solutions to their existing customers.

Regional Analysis

North America:

North America leads the global market due to a high level of pet humanization and well-established veterinary care systems. The presence of major insurers and a growing culture of preventive pet care have solidified the region’s leadership position.

Europe:

Europe remains a strong market with consistent policy growth, especially in the UK and Nordic countries. Increasing awareness of pet health insurance and favorable regulations support the market’s maturity.

Asia-Pacific:

Asia-Pacific is projected to record the fastest growth rate. Urbanization, rising disposable income, and the emotional shift toward treating pets as family members are key contributors. Countries like Japan, China, and India are witnessing rapid increases in policy adoption through digital platforms.

Rest of the World:

Latin America, the Middle East, and Africa present emerging opportunities. These regions have lower insurance penetration but are experiencing increasing pet adoption and awareness campaigns, creating fertile ground for new market entrants.

Key Market Trends

The pet insurance market is evolving with several transformative trends shaping its future trajectory:

1. Digital Transformation:

Insurers are embracing digital platforms for policy issuance, claims processing, and customer support. Mobile applications, AI-powered chatbots, and cloud-based data systems are improving customer experience and transparency.

2. Data Analytics and Personalization:

Advanced analytics allow insurers to assess pet health risks and offer customized premium plans. Predictive modeling based on breed, age, and health history is becoming a standard feature.

3. Expansion of Tele-Veterinary Services:

Telehealth integration is changing how policyholders access veterinary services. Insurers are partnering with tele-vet platforms to offer instant consultations and preventive care.

4. Preventive and Wellness Plans:

There is growing demand for preventive care coverage, including vaccinations, health check-ups, and nutrition support. This shift reflects the growing trend toward holistic pet wellness.

5. Partnerships and Ecosystem Integration:

Insurers are forming alliances with veterinary clinics, pet stores, and technology providers to build complete pet-care ecosystems—covering everything from healthcare to lifestyle services.

6. Awareness and Education Initiatives:

Many insurers are investing in marketing and educational campaigns to raise awareness about the financial and emotional benefits of pet insurance. This has proven especially effective in developing markets.

Market Opportunities

The pet insurance industry offers several high-value business opportunities for investors, insurers, and pet-care providers:

1. Entry into Emerging Markets:

Countries with growing pet populations but low insurance awareness represent untapped potential. Strategic partnerships with local veterinary chains and digital distribution can accelerate growth.

2. Product Diversification:

Developing tailored policies for different animal types, breeds, and income segments allows insurers to capture diverse customer bases.

3. Integration of Pet Health Technology:

Wearable pet health devices and AI-based diagnostics present a major opportunity for data-driven policy customization and predictive care.

4. Ecosystem Partnerships:

Collaborations with veterinary clinics, pet pharmacies, and wellness centers can provide cross-selling opportunities and improved customer loyalty.

5. Customizable Subscription Models:

Flexible subscription plans allow customers to adjust coverage based on a pet’s age and health, ensuring retention and long-term profitability.

Challenges Facing the Industry

While the outlook is positive, several challenges must be addressed for sustained growth:

-

Low Awareness in Emerging Markets: Many pet owners are unaware of the benefits of insurance or perceive it as unnecessary until emergencies arise.

-

Rising Veterinary Costs: Advanced medical technologies improve care but increase claims, impacting insurer profitability.

-

Regulatory Variations: Differing regulations across countries can hinder global standardization.

-

Customer Retention: Maintaining long-term policyholders requires exceptional service, fast claims processing, and transparent communication.

-

Data Privacy Concerns: With increased digitalization, insurers must prioritize cybersecurity and data protection to maintain customer trust.

Future Outlook and Strategic Insights

The global pet insurance market is on a strong upward trajectory, supported by evolving consumer behavior and technological innovation. As pet parents increasingly treat animals as family members, spending on pet health will continue to climb.

In the coming decade, insurers that embrace innovation, data-driven pricing, and integrated pet-care ecosystems will lead the market. Companies focusing on affordability, transparency, and seamless digital experiences will earn strong brand loyalty.

Key strategic imperatives for success include:

-

Developing localized, affordable insurance products for emerging economies.

-

Investing in digital claim automation and mobile-first platforms.

-

Leveraging partnerships with veterinary networks and telehealth providers.

-

Building educational campaigns to drive consumer awareness.

-

Introducing preventive wellness packages that reduce long-term claim costs.

The combination of these strategic factors ensures that the pet insurance industry remains one of the most promising areas for investment and innovation in the insurance sector.

More Related:

pet insurance reddit best pet insurance nationwide pet insurance spot pet insurance pet insurance - state farm pet insurance metlife pet insurance companies pet insurance for dogs that covers everything lemonade pet insurance pet insurance ahm insurance for pets insurance pet pets insurance insurance nationwide pet dog insurance dog pet insurance pet insurance dog best pet care insurance better pet insurance good pet insurance pet insurance best dogs insurance insurance for dogs pet insurance for a dog pet insurance for dogs insurance dog metlife pet insurance metlife insurance pet metlife pet insurance coverage metlife insurance for pets best dog insurance best dog pet insurance dog insurance best pet health insurance spot insurance nationwide pet pet nationwide dog health insurance dog pet health insurance metlife pet pet insurance company dog health care insurance dog insurance health lemonade insurance pet pet insurance nationwide pet insurance plans pet insurance plans for dogs reddit pet insurance lemonade dog insurance is pet insurance worth it reddit nationwide pet insurance sign in spot dog insurance nationwide pet insurance for dogs lemonade cat insurance dog insurance nationwide nationwide pet insurance dogs pet insurance lemonade spot insurance for pets my pet insurance nationwide dog insurance reddit reddit dog insurance pet spot insurance pet insurance spot pet lemonade insurance pet insurance for dogs reddit lemonade insurance for dogs metlife for pets nationwide cat insurance dog insurance lemonade lemonade insurance dog lemonade pet insurance plans spot pet health insurance the spot pet insurance is dog insurance worth it reddit lemonade pet insurance policy metlife for dogs what does pet insurance cover reddit metlife pet insurance plans spot insurance dog dog insurance spot pet health insurance reddit metlife insurance for dogs Pet Insurance pet insurance state farm pet insurance for cats pet insurance comparison pet insurance australia pet insurance canada pet insurance copyright pet insurance woolworths embrace pet insurance fetch pet insurance trupanion pet insurance tesco pet insurance nationwide pet insurance login pets best insurance

Conclusion

The pet insurance market is entering a transformative era of rapid growth, technological integration, and expanding consumer acceptance. As global pet ownership rises and healthcare costs increase, insurance solutions tailored for pets are becoming essential rather than optional.

For businesses, this represents a compelling opportunity to innovate, capture new markets, and deliver value through digital, data-driven, and customer-centric models. The future of pet insurance lies in blending empathy with analytics—ensuring that every pet receives the protection and care they deserve while creating a sustainable and profitable market ecosystem.